Do you feel stressed about a tight budget? Guess what, the world inflation increased madly, inflation means everything you buy is getting more expensive than it was a year ago.

Your salary is not growing up compared to the inflation rate, and you are used to a certain level of living, but now with your limited resources.

You must work something smart to survive the world inflation in the year 2022. If we took a look at the USA as an example of a big stable economy, we will notice that According to the US Bureau of Labor Statistics, food, and electricity costs have each increased by 7.9%,

If you need to set up a new home, note that consumer price inflation increased, as apparel is now 6.6% more expensive. Gasoline prices increased by 38%, so you need to focus a little on how you are exhausting gas. On the other hand, used vehicles have increased by 41.2% so buying a used car will not be that easy anymore. The medical care costs are up 2.5% and rising expectations for a continuous increase in inflation during the year.

It’s no wonder your budget may be struggling to keep up! So, how you manage your spending, shapes the life you are living every day. Don’t get frustrated about exhausting your money and try to follow those steps:

1- Beat inflation, and eliminate unnecessary expenses.

– Look at your weekly and monthly expenses and cut out unnecessary expenses.

– cancel monthly subscriptions such as a video/music streaming service, monthly beauty box, or unused health club membership.

– Do things yourself for cleaning the house, and taking care of the yard. Until prices start to decline, you will pack your lunch if you are working outside your home.

– If you work outside your home, pack a lunch from home instead of going out to eat. Cutting out even the smallest expense can really add up over time.

2- Go shopping differently.

Adjusting how you shop for groceries can make a big impact on your wallet.

– shop for generic brands or store brands and avoid buying branded expensive products, Doing so could save you 20-25% on the same product

– buy fruits, vegetables, and meats from the frozen foods department. They are healthy, last longer, and could cost you up to 50% less. Instead of buying from fresh food departments.

– follow the sale and discount newsletter for different shops to buy your needs, always discounted.

3- Save your energy bill

There is a cost of not paying attention to keeping the lights on and using a high-temperature heater or even keeping the water running besides AC systems.

– Use led lighting and change your regular light bulb with LED bulbs already.

– Reduce your total bill by Some simple things you can do, including solar panels or wind turbines.

– Fixing drafty doors and windows; which leak heating, turning the thermostat up a few degrees in the summer and down a few degrees in the winter.

– Purchasing energy-efficient appliances.

– Take shorter showers.

– Washing clothes in cold water.

4- Don’t waste gas.

Gas consumption depends on the type of vehicle you drive. Try to save gas by prior planning for your trips

– try to shop once a week for your grocery and make only one trip to the grocery store.

– try to use rides sharing, and carpooling.

– plan to go near destination trips in one day.

– Consider reducing your speed by 5 to 10 km per hour when you drive to improve your fuel consumption by about 14%.

-turn off your car while waiting, an idling car can use up to 2 liters of gas per hour!

5- Pay off your debt.

Eliminate your monthly debt obligations from past purchases, It’s important to make at least the minimum payments on your balances each month, paying more than the minimum will help pay off your debt faster

6-Increase your income resources

Increasing the amount of money you make each month is another way to cover the rising cost of goods and services.

– Consider asking your current employer for a raise. The worst thing they can say is no. Or

– if you have a hobby that could be turned into a profitable side business.

– sell unused items that are lying around your home collecting dust.

7- Invest for the future.

While it’s difficult to adjust your payment budget but still you need to invest money. At least 3 – 6 months of living expenses are set aside in an emergency savings fund to cover unforeseen circumstances such as a job loss, health issue, or home repair.

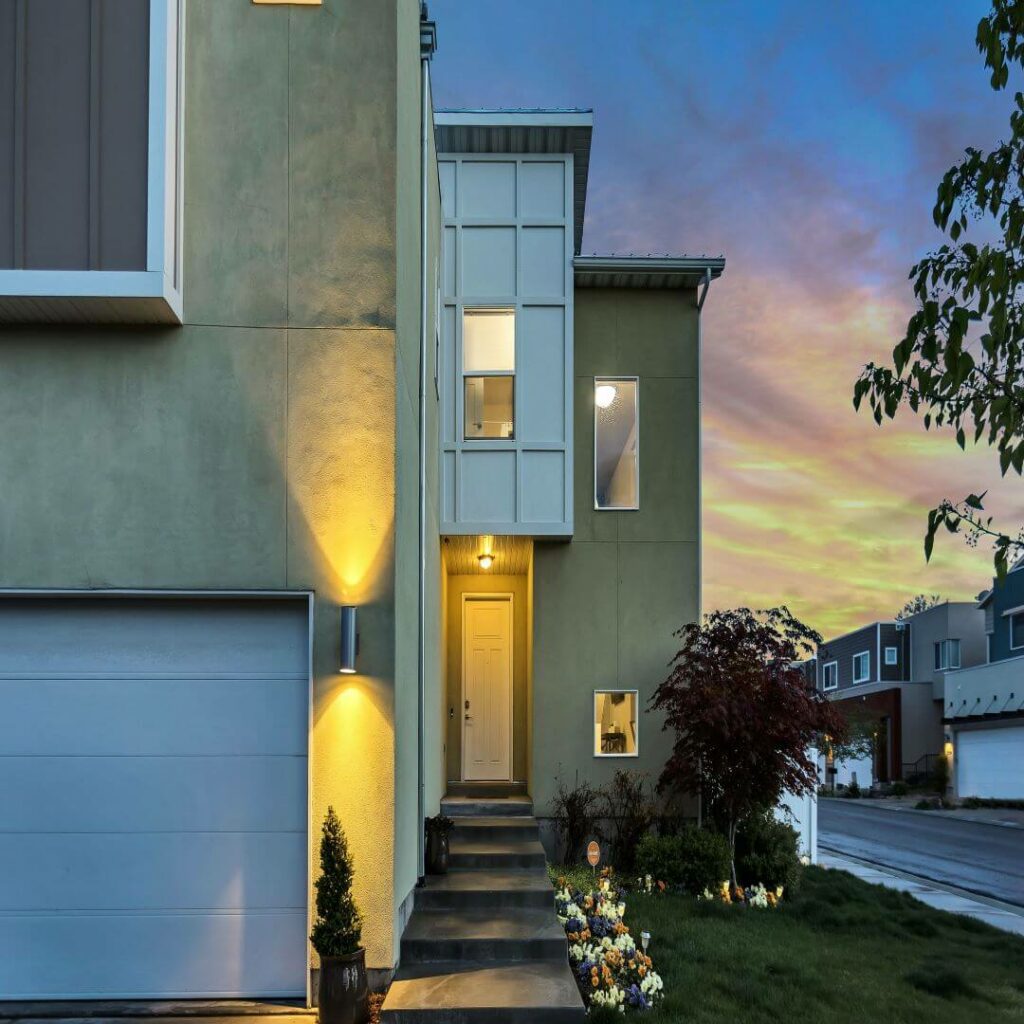

One sure way is to invest in real estate, so you need to build flats or villas and offer them for rentals. Real state is a very common backup plan for smart passive income.